Table of Content

Before diving deeper into what “leave the home” actually means, understand that you've got got the option of paying off a reverse mortgage anytime without a prepayment penalty. You also can choose to make payments anytime to lower the outstanding balance of your reverse mortgage. If you do this, for instance, with a reverse mortgage line of credit score, you'll, in impact, be preserving or rising available funds for future use. The absence of month-to-month mortgage payments ought to unlock more spendable cash for you each month. For most seniors, it is a dangerous concept because the price of funds, consisting of the interest rate, mortgage insurance coverage premium and settlement prices would exceed the investment return.

HECM reverse mortgages are distinctive in utilizing two interest rates in each transaction. One rate of interest is used in calculating the borrower’s future debt and future credit score line if there is one. This is the “mortgage rate” and it is comparable to the speed on commonplace mortgages. Ignorance of HECM reverse mortgages is widespread as a outcome of HECMs are difficult and really unlike the standard mortgages with which most seniors bought their houses.

Mortgage Insurance Coverage Premiums

Many reverse mortgage borrowers use a reverse mortgage line of credit score as a sort of long-term care medical well being insurance coverage. Any portion of the line that you don’t touch will proceed to increase, providing you with a growing, go-to source of funds that can help you pay for medical emergencies or your long-term care needs. On a normal mortgage, you build fairness over time as you pay down the loan balance.

As reverse mortgages become extra in style, brokers often area questions from retirees worried about what measures are in place to protect them in a interval of their lives when circumstances can change all of a sudden. Contact the corporate servicing your reverse mortgage to search out out your choices. If you can’t repay the reverse mortgage stability, you might be eligible for a Short Sale or Deed-in-Lieu of Foreclosure.

Interest Charges And Your Revenue Taxes

If the heirs – or anybody inheritor – need to purchase the home, they will repay the loan and take title. This can be accomplished by putting up the money required to repay the loan, through the use of a standard mortgage, or using a home equity loan on one other property. The financing options obtainable are restricted solely by the creativeness and credit worthiness of the client. If someone desires to buy the property, the one obstacle that they are prone to encounter might be tips on how to provide you with the complete amount of the existing mortgage steadiness regardless of the home’s appraised value.

Furthermore, even when lenders did publish prices, very few borrowers would have the flexibility to use the data successfully. Draw the biggest potential initial or future credit score line, with or with no money draw. You wish to access as much cash as possible proper now to meet a direct want, such as paying off short-term debt. You need to enhance your present and future monthly revenue, and keep a reserve for special events or unanticipated needs.

Is A Reverse Mortgage Borrower Required To Buy Mortgage Insurance Coverage Premium (mip)?

Some relocation assistance may be out there that can help you gracefully exit your home.ForeclosureIf your mortgage goes into default, it could become due and payable and the servicer could begin foreclosure proceedings. A foreclosure is a legal process where the proprietor of your reverse mortgage obtains possession of your property. Even if you’ve received a foreclosures discover, you might still have the power to keep away from foreclosures by pursuing one of many options noted above. A Home Equity Conversion Mortgage or HECM is the one reverse mortgage insured by the Federal Housing Administration.

You need to remove the month-to-month cost on an present mortgage, and if there is something left over, take a month-to-month payment for so lengthy as you reside in the house. The borrower attracts the most important out there monthly fee for as long as she resides in the home, she lives to one hundred, and her home doesn’t rise in worth. Accrued interest that is added to the loan balance just isn't deductible. A compensation by the borrower is deductible so long as the amount doesn't exceed the interest that has accrued in the loan steadiness.

What Are The Necessities Of A Reverse Mortgage?

It permits Americans 62 and older to borrow money against the equity in their residence, with no obligation to repay as long as they stay there. Once the home sells, the lender is paid back in full from the proceeds. Loans might come in the type of a lump sum or lifetime month-to-month payments and can also embody a line of credit. Line of Credit-This is the preferred choice, doubtless because it's also probably the most flexible. You draw upon your credit score line as you want it, as much as your principal limit.

One of these scams was eight Figure Dream Lifestyle, which touted a “proven business model” and informed... If you select to click on on the links on our site, we may obtain compensation. If you don't click on the links on our web site or use the telephone numbers listed on our website we is not going to be compensated. The content material on this web page provides common shopper information.

Is It Attainable For An Estate Or Heirs Of The Borrower(s) To Receive Funds After The Ultimate Settlement Of A Reverse Mortgage?

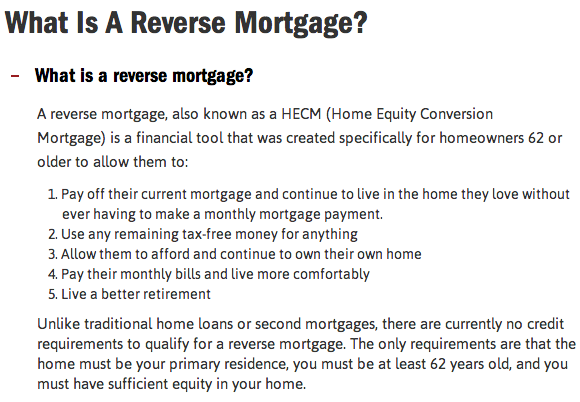

A reverse mortgage is a house fairness mortgage solely designed for individuals 62 or older. These cash funds, plus the lifetime elimination of any month-to-month mortgage payments, can instantly improve your monthly money move while also serving to you meet your longer-term retirement targets. A reverse mortgage requires that you preserve your property and frequently pay your property taxes and homeowners insurance coverage.

They differ in that beginning in 5 or 10 years, the HELOC borrower must start paying down the loan balance, whereas with a HECM there is no compensation obligation as long as the borrower resides in the home. Further, with a HECM the borrower can draw a monthly cost for so lengthy as she resides in the home. Your reverse mortgage firm (also known as your “servicer”) will ask you to certify on an annual basis that you're dwelling within the property and maintaining the property. Additionally, your mortgage company could remind you of your property-related expenses—these are obligations like property taxes, insurance coverage funds, and HOA charges. However, these bills are your duty so make sure you’ve put aside enough money to pay for them and ensure to pay them on time.

Reverse mortgages can expend the fairness in your home, which means fewer belongings for you and your heirs. Most reverse mortgages have one thing known as a “non-recourse” clause. This implies that you, or your property, can’t owe more than the value of your personal home when the mortgage turns into due and the house is offered. With a HECM, usually, should you or your heirs wish to pay off the mortgage and hold the home quite than sell it, you would not need to pay more than the appraised worth of the house.

As long because the borrower of a reverse mortgage is alive and maintaining primary residence at the designated property, a key selling level of those loans is that they guarantee continued residence ownership. To retirees, this offers peace of thoughts that they will not be and not utilizing a place to reside of their twilight years. Unfortunately, that guarantee turns into null and void as quickly as it’s time to repay. In the case of the borrower’s demise, non-borrowing spouses and different relations are given the primary alternative to pay back the loan balance.

‘nerdy’ Year-end Planning Suggestions For 2022: Jeff Levine

In order to qualify for a reverse mortgage, the Federal Housing Administration has mandated several necessities. First and foremost, any potential borrower must 62 or older. Furthermore, an applicant must own his or her home outright, or else have a minimally low excellent mortgage stability.

No comments:

Post a Comment